[ad_1]

Tokyo-based VC firm Incubate Fund announced on Tuesday that it has established a new growth fund called IFGO worth 16.1 billion yen (about $147 million). This is the sixth flagship fund for the firm since its first fund established in 2010 (excluding regional funds and franchise funds in India, the US, and Brazil). With the launch of the new fund, Incubate Fund’s AUM (assets under management) has reached approximately 62 billion yen (about $567 million). Focusing on follow-on investments in their more than 400 portfolio companies, the firm will start investing in middle- and later-stage startups.

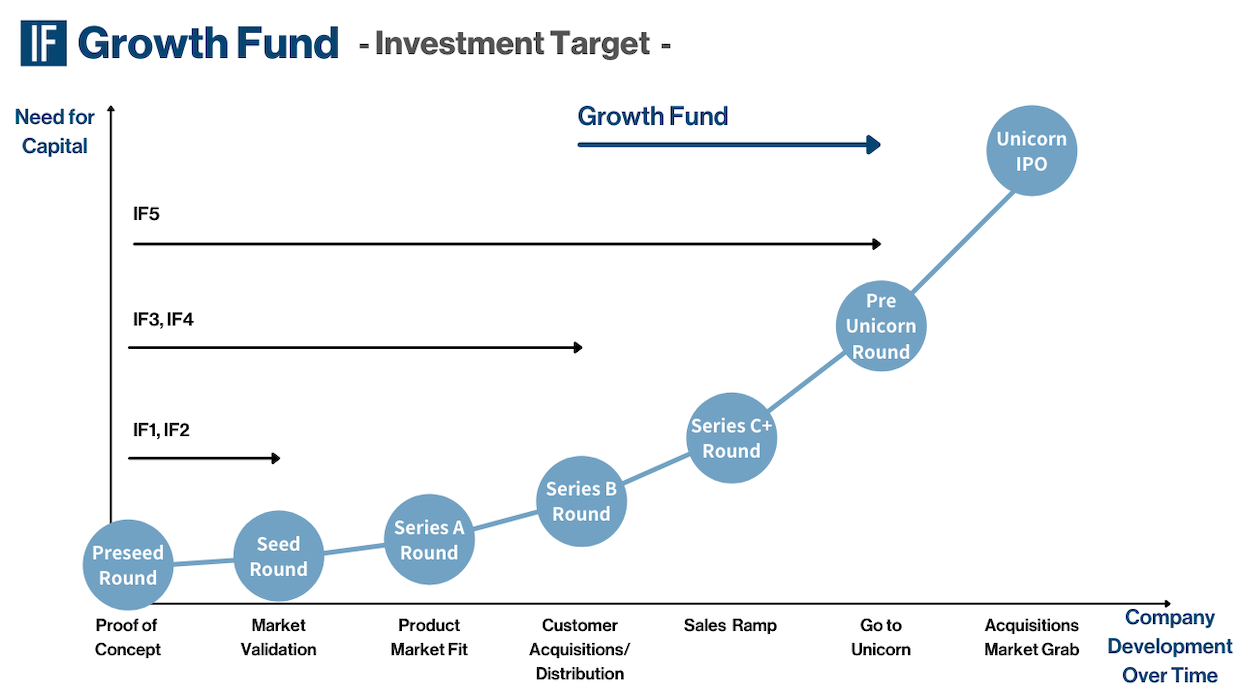

The firm has been focused on investing in early-stage startups, especially those in seed to series B rounds. When a promising startup in need of funding came to the firm but they are in the middle or later stage, the firm may have experienced to decline the startup’s request due to scope mismatch. In an interview with Bridge, Masahiko Honma, the firm’s founder and managing partner says, the new fund is to actively invest in the firm’s portfolio startups preparing for IPO and help them become unicorns.

The fund’s ticket size is expected to be 500 million to 2.5 billion yen (about $4.6 million to 22.8 million), aiming to actively lead pre-IPO rounds. If it is possible for middle- and later-stage startups to secure billions of yen in their pre-IPO round, they will no longer have to rush into an IPO but will be able to gain sufficient profitability, recognition, an appropriate valuation before it. The Japanese market used to be ridiculed for having many small IPOs compared to the U.S. and other countries, but the recent emergence of growth funds and large funds in Japan may help resolve these issues.

The firm also disclosed some of the investees from the new fund: ispace (lunar development), BellFace (online sales SaaS), Wovn (website multilingualization solution), Timers (parenting app development), Caster (online secretary and assistant), and Satori (marketing automation tool developer). Since all these startups have won a certain level of recognition from the market, there’s no doubt if any of them has started countdown to an IPO.

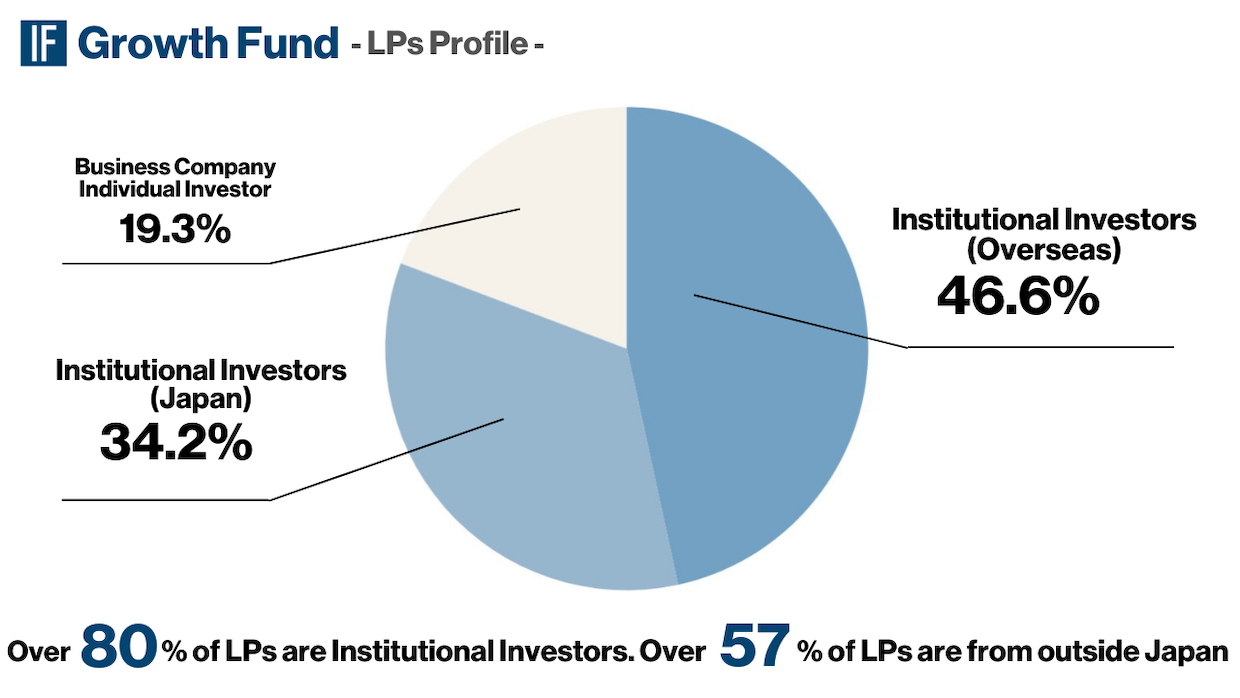

About 57% of the new fund is backed by financial institutions and university foundations from North America, Hong Kong, and Singapore. Honma says there may be two main reasons behind the fact. First, the firm proactively disclosed their track records, sharing their performance to date in terms of DPI (Distributions to Paid in Capital) with potential investors, which helped gain the latter’s great understanding.

Secondly, geopolitical trends have also had a significant impact on the market. Due to the offensive between the U.S. and Chinese governments, as well as the restrictions imposed by the Chinese government, China’s big tech market is becoming increasingly suspicious. Even though we don’t know much about the inner workings of the market, the world’s money, with its huge appetite for consumption and expectations of speculative growth, is losing its way here. The Japanese market has been attracting attention because of its moderate market size, stable politics and economy, and steady real returns.

Honma says,

I have wanted to launch such a fund for a long time. Asked about why we could do it at this time this year, I think it’s significantly triggered by the momentum.

Incubate Fund has a strong presence in Japan, but I had a strong impression that they are pouring money from Japanese investors into promising startups in Southeast Asia, as Homma is based out of Singapore and they have invested in KK Fund other funds in the region. With the launch of the new fund, a two-way money flow will be created where funds from overseas will be invested in Japanese startups, which will benefit their international business expansion in the future.

Since the beginning of this year, Japanese independent VC firms have launched a series of large funds worth over 10 billion yen (about $9.1 million): One Capital closed its first fund with 16 billion yen while University of Tokyo Edge Capital Partners (UTEC) launched its 30 billion yen fifth fund. Coral Capital launched its third fund worth 14 billion yen, revealing that a third of its investors are from overseas.

[ad_2]

Source link