[ad_1]

UniSwap Pros

- User-friendly design

- Full transparency and open source code

- High interest for liquidity provision

- No KYC process

- No registration

- All ERC20 tokens supported

UniSwap Cons

- Doesn’t accept fiat currency

- Risk of impermanent loss

- Only supports assets on the Ethereum blockchain

- High transaction and gas fees

Uniswap is an innovative decentralized exchange protocol that aims to solve decentralized exchanges’ liquidity problem by allowing the exchange platform to swap tokens without relying on buyers and sellers creating that liquidity. Uniswap exchange incentivizes its users to maintain the exchange’s liquidity, providing portions of the transaction fees and newly minted UNI tokens to those who participate.

UNI is the token for Uniswap. It’s a governance token, so owners can participate in decisions on network upgrades and policies, with each vote being proportional to the amount of UNI cryptocurrency they stake.

Read on for our UniSwap review to learn everything you need to know about the Uniswap project, its pros and cons, the UNI token, and how to start making swaps on Uni.

Let’s dive right into it!

Decentralized Exchange

Decentralized exchanges, alternatively known as DEXs, are peer-to-peer marketplaces where crypto traders transact without a custodian or intermediary to authorize and oversee trades. DEXs serve as an alternative to centralized exchanges. They use liquidity pools instead of full-fledged order books and let users trade in a safe and private environment. The transactions on DEXs are facilitated through a smart contract, a self-executing agreement written in code.

Centralized exchanges offer services similar to those provided by a bank. The bank safeguards its clients’ funds and includes surveillance and security services. In contrast, decentralized exchanges, like UniSwap, offer autonomous on-chain transactions at marginal costs by leveraging smart contracts.

Traders have to guard their funds and take responsibility for losing them if they make mistakes such as dispatching funds to the wrong address or losing their private keys. Deposited assets or funds of customers are issued an IOU (I own you) via decentralized exchange portals. An IOU is a blockchain-based token with the same value as the underlying asset, and anyone can trade an IOU on the network.

The Ethereum blockchain is host to the most popular decentralized exchanges.

UniSwap App Review

Overview

UniSwap is an automated liquidity protocol and one of the most popular decentralized exchanges in the crypto market. As an Ethereum based protocol, the UniSwap exchange creates liquidity between ERC 20 tokens by employing an autonomous liquidity system, a relatively new trading mechanism that eliminates the need for certified intermediaries while prioritizing scalability and security.

UniSwap offers an entirely self-regulated, decentralized environment where users maintain total control over their funds, unlike a centralized exchange which makes users give up their private keys. As such, no single business can own, manage, or govern its platform.

UniSwap became the first widely used permissionless DEX to let users trade any Ethereum based token directly, without any withdrawal or deposit to a Centralized order book. Uniswap removes the concept of order books in favor of an automated market maker to provide the best possible market rate using a special, deterministic algorithm. Users merely select an input and output token rather than specifying what price to buy or sell crypto, while Uniswap provides the best possible market rate.

UniSwap has developed into one of the most popular exchanges on the Ethereum blockchain for people to trade crypto and swap assets. The exchange doesn’t hold assets and lacks an order book; this makes UniSwap safe compared to traditional exchanges.

Anyone can use the UniSwap protocol to trade ERC-20 tokens and earn trading fees by providing liquidity to the protocol.

UniSwap Review (Background)

Hayden Adams, a young yet talented designer/developer, is the founder of UniSwap. Hayden and a small team of less than 10 built the DEX with a $100k grant from the Ethereum Foundation.

In April of 2019, UniSwap closed a $1M seed round lead by paradigm and went on to release UniSwap V2 in May 2020.

UniSwap has since raised an $11M Series A round, launching its native token UNI and solidifying its place as the top DEX on Ethereum.

UniSwap Versions

UniSwap has launched successive versions with updated protocols while its user base increases.

UniSwap v1

On Nov 2, 2018, UniSwap version 1 was launched on the Ethereum mainnet. UniSwap V1 supported only the swapping of ETH-ERC 20 pairs. If users wished to swap USDC for DAI, they first had to swap USDC for ETH, then ETH-DAI to get DAI.

UniSwap V1 also facilitated the concept of LP tokens. When a liquidity provider adds liquidity to any pool, they receive liquidity provider tokens, Representing the added liquidity. These LP tokens can then be burned or staked to redeem rewards. Trading fees are incurred to reward LPs.

UniSwap V2

The Proof-of-Concept of the UniSwap V1 was a great hit that boosted the network to launch the updated UniSwap V2 in May 2020.

UniSwap V1’s major drawback was the “ETH bridging” problem, i.e., the absence of ERC20-ERC20 token pools, which resulted in high spillage and escalated costs when a user wanted to swap one ERC20 token.

Uniswap V2 was an upgrade in user interface and experience. Also, it eliminated the ETH bridging problem by letting in the concept of ERC20-ERC20 pools. The usage of wrapped ETH instead of native ETH in the core contracts, flash swaps, and a native price oracle are other significant differences between UniSwap V2 and UniSwap V1. However, through helper contracts, traders can use ETH.

UniSwap V2 Flash Swap

UniSwap flash swap concept allows users to withdraw any amount of ERC20 tokens without an upfront payment. However, they could either pay for the tokens withdrawn or pay for a portion and return the rest or return all the withdrawn tokens at the end of the transaction execution.

UniSwap also introduced a protocol fee, and community governance plays a fundamental role in turning this fee on or off. 0.05% of the 0.3% trading fee is taken as the protocol fee and is reserved for the UniSwap platform development that shapes the roadmap of the network.

UniSwap V3

UniSwap launched its latest version UniSwap V3 in May 2021 on the L1 Ethereum mainnet. The original announcement in March 2021 said that an L1 optimism deployment was expected to follow shortly afterward.

Unlike V1 and V2, UniSwap V3 provides a flexible fee structure with better accuracy and capital efficiency. Compared to V2, liquidity providers get high returns on their capital to provide liquidity with 400x capital efficiency.

UniSwap V3 aims to surpass centralized exchanges and stablecoin-based automated market makers by facilitating low-slippage trade execution.

Features of UniSwap V3

Concentrated Liquidity: The shape of the AMM can be estimated by liquidity providers, as they can build unique price curves based on their preferences. LP’s capital can be centralized within custom price ranges, enhancing their liquidity at desired prices. Concentrated liquidity is intended to diminish the amount of capital the trader must commit. This feature ensures the higher capital efficiency of the asset pool. The V3 pool contract does not support standard ERC20 tokens; it instead requires that the contracts are backed by additional logic for reinvesting and distributing the fees collected.

Active liquidity: Liquidity is automatically taken out of the pool and will no longer earn rewards when the market experiences price changes beyond the LP’s specified price range. While waiting for the market to drive at the specified price range, the liquidity is shifted to less valuable assets; this ensures the wellbeing of LPs in the UniSwap trading ecosystem. To start earning rewards again, LPs can update their price range to meet the current market price range.

Fee Flexibility

UniSwap V1 flat fee was 0.3%. The entire cost was allocated for LP rewards.

UniSwap V2 has a total fee of 0.005%, reserved for the network’s development.

UniSwap V3 arrives at government governed flexibility through three various fee tiers:

- 0.05% for stablecoins like DAI/USDC

- 0.3% is incurred by standard non-correlated pools like ETH/DAI

- 1.00% for non-correlated pairs.

Turned off by default, one can turn on the protocol fee for particular pools through governance, and the cost can be set between 10%-25% of LP fees.

Liquidity Pools

UniSwap is an automated liquidity protocol. Automated Market Marker (AMM) refers to smart contracts that provide liquidity pools/reserves that traders can trade against. Liquidity providers can create liquidity pools by depositing tokens into an Ethereum based smart contract. The pool may comprise stablecoins such as USDT, DAI among others. The traders who utilize the AMM are charged a fee which is distributed across the liquidity providers according to the percentage they have staked in the pool.

The UniSwap ecosystem relies on two types of smart contracts, namely an exchange and factory contract. The exchange contract’s purpose is to hold a pool consisting of specific tokens. The factory contract is how users create new exchange contracts. These pools contain pairs of tradable currencies; for example, an investor might put ETH and UNI into a liquidity pool on UniSwap; they’d then get a percentage of the trading fees each time ETH is swapped for UNI or UNI for ETH.

UniSwap’s liquidity pools have little to no price impact for the vast majority of transactions due to underlying mechanisms.UniSwap uses the constant product market maker model that enables the exchange always to provide liquidity, irrespective of the size of the liquidity pool. For this market maker model to work, the spot price of any given asset increases as the desired quantity increases. Although large orders may suffer from increased price impact, running out of liquidity is never a worry for the system. This means UniSwap always maintains an aggregate supply of smart contracts; meaning, the larger the pool gets, the lower the slippage across any trading pair is likely to be.

To help mitigate, Uniswap allows one to specify a maximum price when placing an order.

Liquidity Providers

UniSwap can offer crypto trading because of its liquidity providers or LPs. By providing liquidity, LPs earn crypto because they receive a cut of the exchange’s transaction fees. By submitting collateral for both sides of the market, LPs can provide capital to any liquidity pool; this means that you must offer an equal amount of DAI and USDC if you’re looking to provide capital to the DAI/USDC market to maintain the Constant Product automated market maker.

UniSwap grants users liquidity tokens, which record how much of any given liquidity pool you’re responsible for when liquidity is supplied. Liquidity providers can redeem their tokens at any time for the underlying collateral.

UniSwap charges a 0.3% fee on each transaction, split amongst all the liquidity providers to incentivize them; these fees are immediately added back to the market at the transfer time, resulting in deeper spreads across the board. Pro-rata stakes grant liquidity providers ownership over a larger pool of capital. To put it simply, the more transactions on the market, the more fees collected and the more income a market maker earns.

Transaction Fees

UniSwap charges a fee on each trade. It used to be 0.3% before UniSwap V3 introduced fee tiers based on the liquidity pool volatility:

- Very Stable pairs – 0.01%

- Stable pairs – 0.05%

- Most pairs – 0.30%

- Exotic pairs – 1.00%.

The flat fee of 0.3% for every trade is slightly above the global industry average of around 0.25%. Yet, one cannot deny that the exchange has a decent offering.

The exchange can get pretty busy, and low gas makes failed transactions common. Trades can also fail, even if there is enough ETH balance to cover the gas fees transaction. Although your Ethereum is reverted to you if your transaction fails, once the gas fees are deducted, they are not refunded.

UniSwap withdrawal fees are competitive compared to other exchanges, which charge low trading fees but hit you with high withdrawal fees on your way out. The exchange only charges network fees when a transaction has been executed.

How to Use UniSwap

You can use UniSwap to sell or buy crypto and earn interest. To use UniSwap, you first have to connect your crypto wallet to it and proceed to:

Choose the swap option, then select the crypto you want to trade and the crypto you wish to receive.

With the pool option, you can open a new position and deposit any two cryptos you want to trade in the UniSwap pool, like ETH/USDT. If you’re unsure what to stake, you can check out the top pools for options.

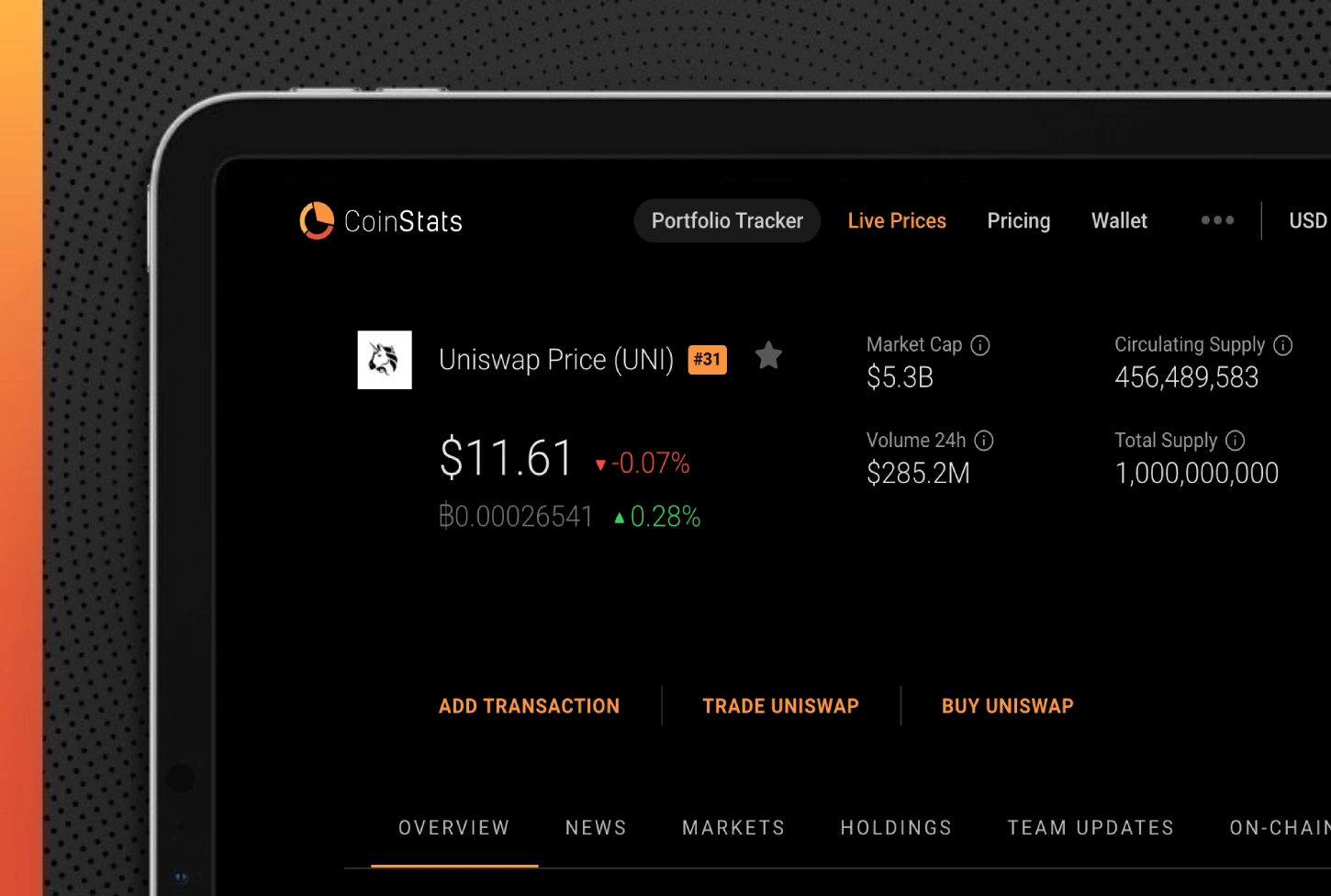

A platform like CoinStats gives you access to the UniSwap exchange and other decentralized finance apps for fast and efficient management of your crypto assets.

Several free crypto wallets, such as Trust wallet, Coinbase wallet, and Metamask wallet are popular options. The CoinStats Wallet is also an excellent solution for storing your cryptocurrency.

Once you have your wallet, generate an address and send your crypto to it. You can then begin trading or staking on the exchange.

Risks

The most considerable risk with trading on UniSwap is buying scam tokens or falling for scam projects like rug pulls. A scam token is a token masquerading as belonging to a legitimate project. Always check and verify the token contract address before you start crypto trading.

Final Thoughts

In a world where barriers and hurdles continue to limit crypto adoption, UniSwap has succeeded in providing a DEX experience that traders have long been searching for.

UniSwap is an excellent choice if you’re interested in leveraging your crypto stakings to grow your holdings. However, as an investor, it’s wise to consider the cryptocurrency market’s high volatility and whether you’re comfortable with the risks involved.

[ad_2]

Source link