[ad_1]

Smart locker is increasingly being accepted, but few people are very clear about its business model. At present, there are two foreign mainstream business models. One is a European and American model, primarily served by express carriers. There have been some third-party companies, such as InPost, but not all have a very clear profit model, and are used as a service tool like the ATM. The second one is a Japanese and Korean model, mainly paid by real estate developers; owners pay 5 cents for each square, about 5 RMB per month per household. On principle, the ones who benefit are the ones who pay.

The Four Beneficiaries

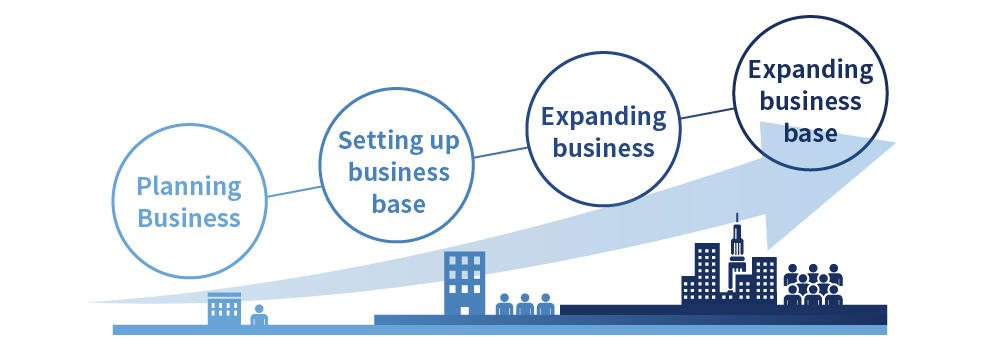

With the emergence of the intelligent smart locker, there are four beneficiaries namely e-commerce companies, courier companies, property companies and individual consumers. Smart Lockers help E-commerce companies sell more goods, express companies save more time, property companies save more manpower, and individual consumers have more free time. But the possibility of co-financing from above four companies is small, so there are 4 types of smart locker business models in China.

The first is invested by e-commerce companies, such as JD, Amazon, JustEasy, Suzhou Fresh Market, etc. The second is the express company, mainly China Post, SF. The third is the third-party operating company, mainly Sposter, FUbox, Manybo. The fourth is a property management company. The first three types can be divided into European and American models; the fourth can be divided into the Japanese and South Korean model.

Who Profits?

The European and American profit model is relatively diverse and complex. The Japanese and Korean model is simple and direct. Which model will win in the end in China, whether it will be the European and American model or the Japanese and South Korean model, is hard to say. Consumers ultimately foot the bill. Whether express companies or property companies can unite or not, currently we can’t see clearly on the smart locker market. If the third-party company can profit, the express company and property company will profit more easily.

The history of smart locker in Japan is nearly 30 years, during which both the express company and third-party company have tried, but finally did not survive, because the smart locker needs a good operation and maintenance service. In Japan, it relies entirely on the developer to buy the smart locker, and owners to pay more property charges to fill operation and maintenance cost. In China, it’s hard to say we have this service sense, but it’s unreasonable that the express company does not completely pay any fee as the beneficiary.

[ad_2]

Source by Jovia D’Souza