[ad_1]

Purchasing investments or foreign currencies is sort of just like purchasing a car.

The choice to invest in one thing is pretty simple.

Exactly what, particularly, to purchase is definitely an completely distinct issue. Before you decide to drive your brand-new vehicle home, you need to select a particular make, a particular design, specific upholstery, a definite colour scheme.

You choose between six cylinders and eight, between normal shift and automatic transmission, and say yes or no to white surfaces, stereo, heating unit, along with a number of additional elective extras.

So with investments. Even though there are just two main groups”bonds and shares” to pick from, the actual versions and refinements and elective extras tend to be as numerous as they are puzzling.

For a lot of traders, one element may be enough cause to ascertain an option. The person of humble means may most likely find corporate bonds at $1,000 each way too high and their 3 per cent interest payment too small for what he is attempting to accomplish.

The wealthy individual may be captivated by the opportunity in common shares but discover that he’d obtain a higher yield through tax-exempt municipals. Just about all investors, however, will do well in becoming acquainted with the different types of investments represented in corporate capital structures so that you can comprehend their impact on one another and their effect on the choice he or she eventually makes for him or her self.

The corporation is definitely an organization marvelously designed towards the needs of all parties involved. It developed in reaction to the requirements of the business community with regard to money over and beyond its very own assets to allow it to develop, expand, and grow.

The fundamental, one-celled type of business life is the individual entrepreneur, the shop proprietor who merchandises products, the artist supplying solutions, the small producer whose cash requirements tend to be met out of personal savings or even via a small bank loan.

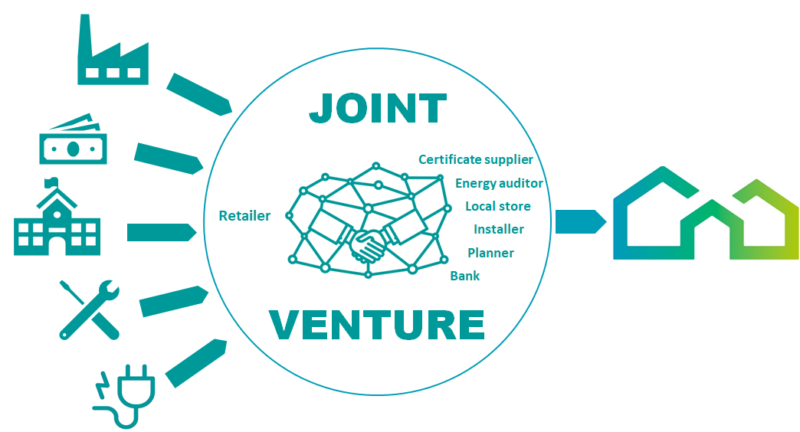

Considerably more complicated would be the partnership, the pooling of the assets of numerous individuals to be part of a joint venture. Most probably the credit of the team is actually more robust compared to the person. The particular partners additionally assume accountability for management of their business, take part in all earnings accruing, and therefore are legally liable for all financial obligations outstanding.

So long as companies continue to be fairly modest, either kind of business is actually adequate. As opportunities for growth present themselves, however, whenever new plant and gear are needed, when larger amounts of raw materials have to be stockpiled, and branch offices and markets underwritten, and staff increased, the individual and the partners are hard pushed. Their own surplus typically is simply too small, their typical credit lines too limited to get the job done.

Enlargement of the venture is no solution. Outside shareholders prepared to undertake the shared responsibilities of partnership, or to immobilize their own money in a partnership contract, are difficult to find. In any event, the range of monetary requirements at this stage generally is so great that only by enhancing the partnership to absurd dimensions could they be fulfilled.

The answer? A public stock corporation. Ownership therefore is distributed amongst as many hundreds or thousands of individuals as are prepared to buy in, their proportional part of the company being represented through the quantity of stock or amount of shares they maintain. Their particular incentive is similarly a proportional share of their company’s earnings.

Their control is practiced through the board of directors they elect. And since their stock is a standardized, known amount and because there are stock exchanges they are able to easily withdraw from the business and sell their own bit of ownership to another person.

The corporation, once set up and in being, is actually an impersonal thing of indeterminate length. Company directors and officers may come and go, traders may buy in and sell out, however the company has a impetus and life force which may allow it to operate forever.

With the Forex picking one foreign currency against another is also comparable, however you have the advantage of utilizing Foreign exchange software to assist you nowadays which could sometimes be downloaded free of charge.

[ad_2]

Source by Silvia Harman