[ad_1]

Statistics show that approximately $80 billion of value is locked in decentralized finance. Despite this figure, many are still exploring the question, “What is DeFi?“

Investopedia defines DeFi as “an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies.” DeFi has attracted many users who wish to eliminate the control of centralized banks and institutions over their financial assets and activities.

Since 2019, DeFiChain has been delivering purpose-oriented offerings to improve DeFi transaction efficiency, speed, and cost-effectiveness. This article will explore DeFiChain’s features, its DFI token, and how to buy DeFiChain.

DeFiChain (DFI): What It Is and How It Works

The DeFiChain blockchain is specially designed to support decentralized finance (DeFi) applications. DeFiChain, developed by the DeFiChain Foundation, focuses on the blockchain’s functionality to enable the fulfillment of quick, intelligent, and transparent DeFi services.

The DeFiChain platform is built as a software fork on the Bitcoin blockchain and tied to it with a Merkle root every few blocks. All transactions on the DeFiChain are non-Turing complete to ensure speed and efficiency with low gas costs and a lower risk of errors in smart contracts.

What Is DFI

DFI serves as the native token of DeFiChain and is an integral account unit in DeFiChain. Users and partners will be issued $DFI coins that can be used to participate in the ecosystem in the following ways:

Paying Fees: The DFI token is the in-house currency used to pay for transactions, DEX fees, ICX fees, smart contracts, and other DeFi activities on DeFIChain.

Liquidity Pools: DeFi holders can use their tokens to provide liquidity for the DEX between crypto-assets.

Staking Nodes: DeFiChain users must have at least 20,000 DFI tokens to fund a new staking node.

Loan Collaterals and Interest: Platform users can put up their DFI tokens as collateral to borrow other crypto tokens. They can also lend other crypto-assets to receive an instant premium in DFI and interest in the form of DFI tokens when the loan is paid back.

DeFi Custom Token: Users must own 1,000 DFI tokens to create a personalized DCT (DeFi Custom Token.) When this custom token is destroyed, the user receives a refund for the DFI they had used to create it.

Submitting Proposals and Votes: Users can pay 10 DFI to submit a Community Fund Proposal or 50 DFI to submit a Vote of Confidence. The DFI paid for these submissions is non-refundable.

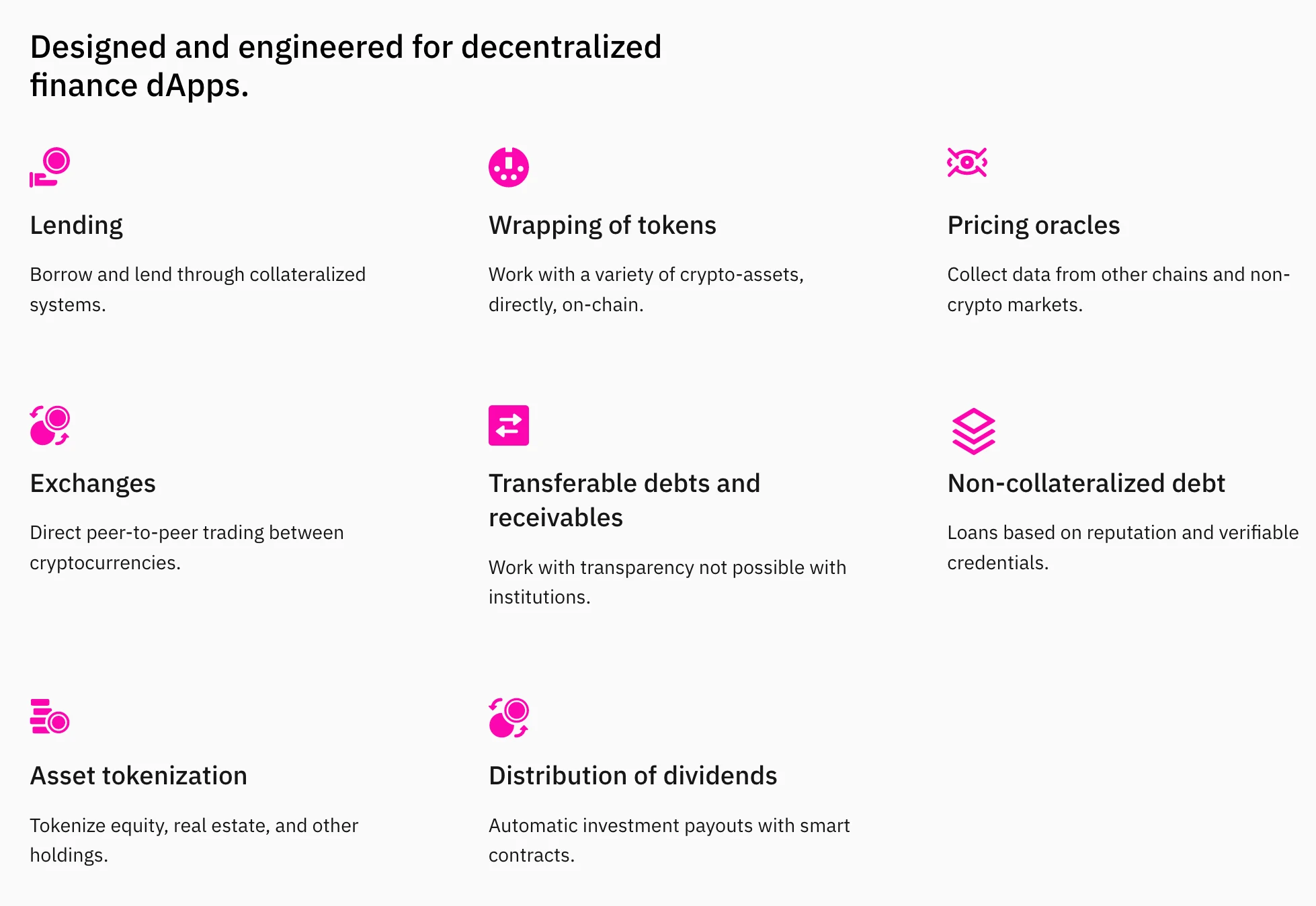

Key Features of DeFiChain

Following are some of the main features of the DeFiChain platform:

Decentralized Lending

With decentralized lending, individuals and groups can avoid the intervention of banks and centralized authorities while borrowing and lending. Despite leading with bitcoin, DeFiChain also addresses 100% of the market through the decentralized wrapping of tokens.

Decentralized Wrapping of Tokens

Wrapping allows individuals to use any digital asset while maintaining the underlying asset but transacting on a different blockchain. DeFiChain features a unique decentralized, trustless wrapping mechanism through which the crypto asset owner can work all their assets on-chain without relying on a third party to act as a guarantor.

Before DeFiChain, there were no interoperability standards connecting different currencies. Wrapping or collateralization (typically provided by a third party) are key requirements since the interaction of different cryptocurrencies and assets requires interoperability.

Owners can easily exchange their wrapped tokens on their respective blockchains for their original value. DeFiChain users are also rewarded for creating a wrapped token on the platform.

The on-chain transaction is done using the native $DFI coin, but DeFiChain can also use Bitcoin, ERC-20, Ethereum, and other crypto-assets through wrapping.

Decentralized Pricing Oracles

Oracles gather accurate information from other blockchains and non-crypto markets to collect data related to the pricing of other crypto-assets. DeFiChain features such pricing oracles that help collect data from eternal blockchains.

DeFiChain network users who participate as an oracle can earn tokens as rewards for the data they provide. These rewards are issued by smart contracts that measure the oracle’s accuracy based on the consensus percentage, number of oracles, and other pre-set parameters.

Decentralized Exchanges

DeFiChain’s decentralized exchange enables atomic, peer-to-peer swapping of cryptocurrencies by directly matching people for trading. Using this DEX reduces the risks of using exchanges while ensuring that the token holder always has custody of their crypto asset. The exchange also doesn’t have to bear the risk of custodianship as the peer-to-peer mechanism is based on an agreed-upon price or the current market price.

Asset Tokenization

Asset tokenization involves representing an asset like real estate or company equity using immutable blockchain-based tokens.

Many projects like LAtoken and Etherparty have made an attempt at blockchain asset tokenization but have eventually pivoted to provide services that aren’t directly associated with asset tokenization.

DeFiChain, on the other hand, offers a module that has been designed specifically for asset tokenization. This module is easy to use for tokenizing real estate, company equity, and other valued asset holdings.

This asset tokenization can also be offered as a legal, authorized, and yet decentralized capability that can be trusted independently.

Dividend Distribution

The dividends distribution module can be used to generate smart contracts that will automatically pay out returns on investment for tokenized assets. DeFiChain offers a leap in the dividends distribution functionality by implementing models with weekly, monthly, quarterly, daily, hourly, or even minute-by-minute payouts.

Transferable Debts and Receivables

In centralized finance, only financial institutions that handle loans can manage debts and accounts receivable. DeFiChain has provided a decentralized alternative in a set of calls that can work with transferable debts and receivables. This has been achieved by using the blockchain, which adds transparency to the process of exchanging debts and loans. Smart contracts will be employed to monitor and manage these loans and debts based on receivables and other financial promises.

DeFiChain also offers the capability to create smart contracts that will support peer-to-peer loans without a financial institution having to guarantee these financial assets.

Decentralized Non-collateralized Debt

At present, DFI is used as collateral for taking out on the platform, and the individual’s identity is established based on their wallet KYC. However, DeFiChain plans to build the appropriate reputation-based systems and risk assessment techniques to offer non-collateralized loans based on borrowers’ reputations and other factors. If successful, this system can be used to supplement or replace the currently used credit score approach.

Where to Buy DFI

When choosing an exchange on which to buy cryptocurrency, it is important to check for the following key factors in crypto exchanges:

Asset and payment support: Compare cryptocurrency exchanges before choosing one that supports the DFI token and the payment method you’re using to fund your purchase. If you plan on swapping other cryptocurrencies in your portfolio to acquire DFI, you should also check whether the exchange supports that trading pair (e.g., BTC/DFI, ETH/DFI, etc.)

Security: Identify a reliable exchange and the link carefully to ensure that you access the authentic exchange platform so that you don’t fall prey to phishing scams.

While DFI is listed on many cryptocurrency exchanges, this article will take you through the detailed procedure for purchasing DeFiChain on CoinStats, a platform that features:

- A reliable crypto exchange for buying DeFiChain

- A secure crypto wallet for storing your DFI

CoinStats also offers informative content like “How to Buy Cryptocurrency” for beginners and specific coin-related articles like “How to Buy STEPN” for potential investors.

Steps for Buying DFI

DFI can be purchased with fiat money or by swapping with other cryptocurrencies. Following are the steps detailing how to buy DeFiChain (DFI) on CoinStats:

- To purchase DeFiChain, you must first create an account on the exchange and link a secure wallet. CoinStats also provides its own wallet that you can use to keep your tokens safe.

- You may have to fill in your KYC details like your name, contact number, and email ID. After your KYC is completed, you can move to the buying stage.

- If you plan to pay with fiat currency, you will have to fund your account with a bank transfer or a credit or debit card. If you’re using a crypto swap, you will have to ensure that the relevant tokens are available in your linked wallet.

- You can then place a limit order by entering your order price in USD or the crypto you wish to swap and selecting the DFI amount. If the price reaches the amount you specified, your order will be processed.

Is DFI a Good Investment

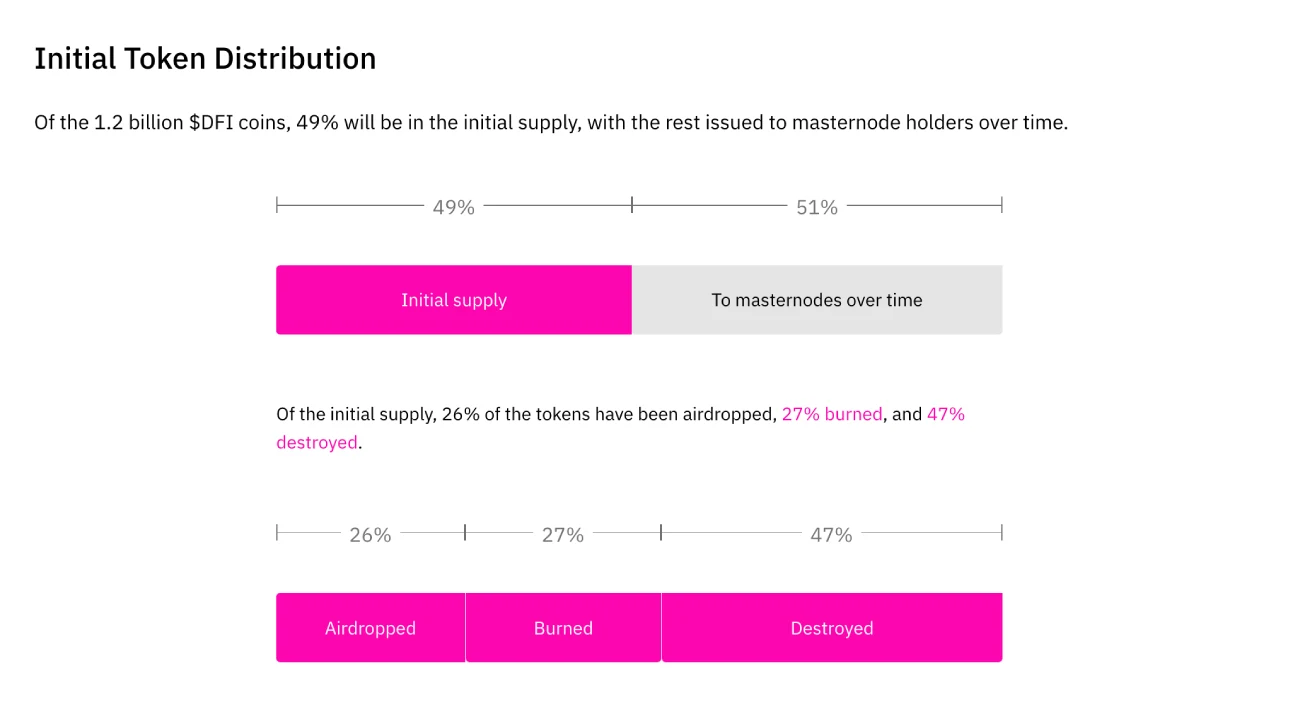

The DeFiChain price as of 25th May 2022 is $2.52, with a 24-hour trading volume of roughly $17 million. The coin currently stands at a rank of #51 on CoinStats, with a circulating supply of around 510 million DFI and a maximum supply of about 1 billion DFI coins.

According to forecasts from walletinvestor.com, the DFI price is expected to have a long-term increase, potentially reaching a price point of $8.98 by 15th May 2027.

Closing Thoughts

Now that you know how to buy DeFiChain, all you’ve got to do is monitor the charts, research the project thoroughly, and DeFiChain tokens based on your existing portfolio and crypto investment plans. Please stay alert to potential scams during this process and ensure that you store your wallet keys safely after you buy your DFI tokens.

[ad_2]

Source link