[ad_1]

Synopsis

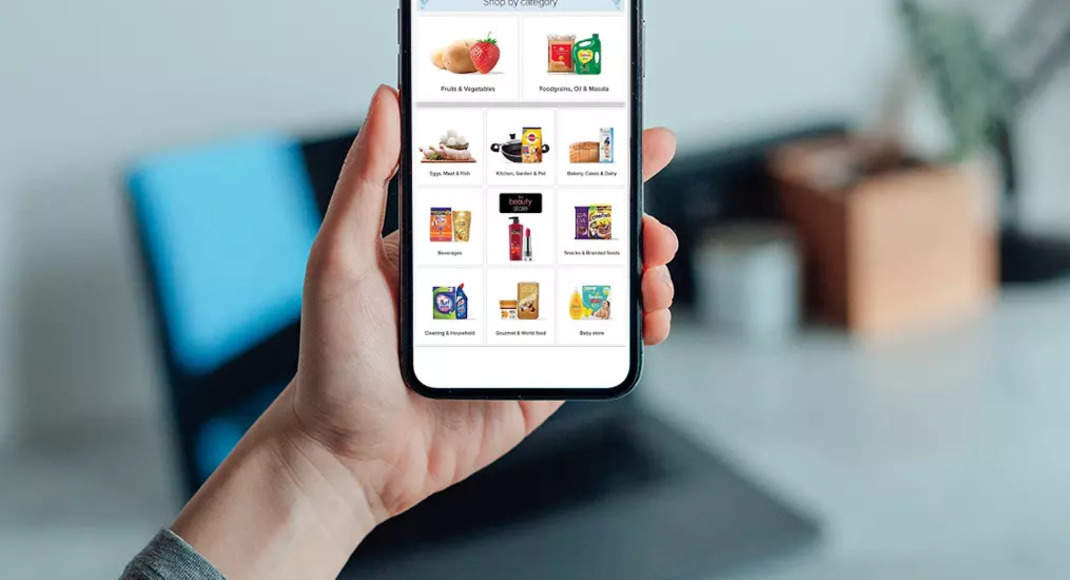

Bigbasket, wedded to strong business ethos, initially stayed away from quick commerce as the math did not make sense. But with well-capitalised instant-delivery upstarts threatening to eat its lunch, the e-grocery leader has been forced to join the fray. Is it already late to the party in the age of instant gratification?

Bigbasket is on the back foot. Younger, hungrier quick-commerce players are eating from its plate. The undisputed market leader in e-grocery is seeing a portion of its over 25 million users — which is the result of gruelling work of a decade — adopting Swiggy Instamart, Zepto, Dunzo, Blinkit, and even the freshly launched Ola Dash. According to Bigbasket insiders and industry executives, the company is witnessing slower-than-anticipated growth,

- FONT SIZE

AbcSmall

AbcMedium

AbcLarge

To read full story, subscribe to ET Prime

Get Unlimited Access to The Economic Times

The Big Budget Sale

@ ₹34 per week

Billed annually at

₹2499 ₹1749(30% off)

Already a Member? Sign In now

Sign in to read the full article

You’ve got this Prime Story as a Free Gift

₹399/month

Monthly

PLAN

Billed Amount ₹399

₹208/month

(Save 49%)

Yearly

PLAN

Billed Amount ₹2,499

15

Days Trial

+Includes DocuBay and TimesPrime Membership.

₹150/month

(Save 63%)

2-Year

PLAN

Billed Amount ₹3,599

15

Days Trial

+Includes DocuBay and TimesPrime Membership.

Already a Member? Sign In now

Why ?

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Clean experience with

Minimal AdsComment & Engage with ET Prime community Exclusive invites to Virtual Events with Industry Leaders A trusted team of Journalists & Analysts who can best filter signal from noise

[ad_2]

Source link