[ad_1]

Long-term holders, however, have managed to retain a high level of conviction

Yassine Elmandjra, analyst at ARK Investment Management, has noted that short-term Bitcoin holders have seemingly capitulated.

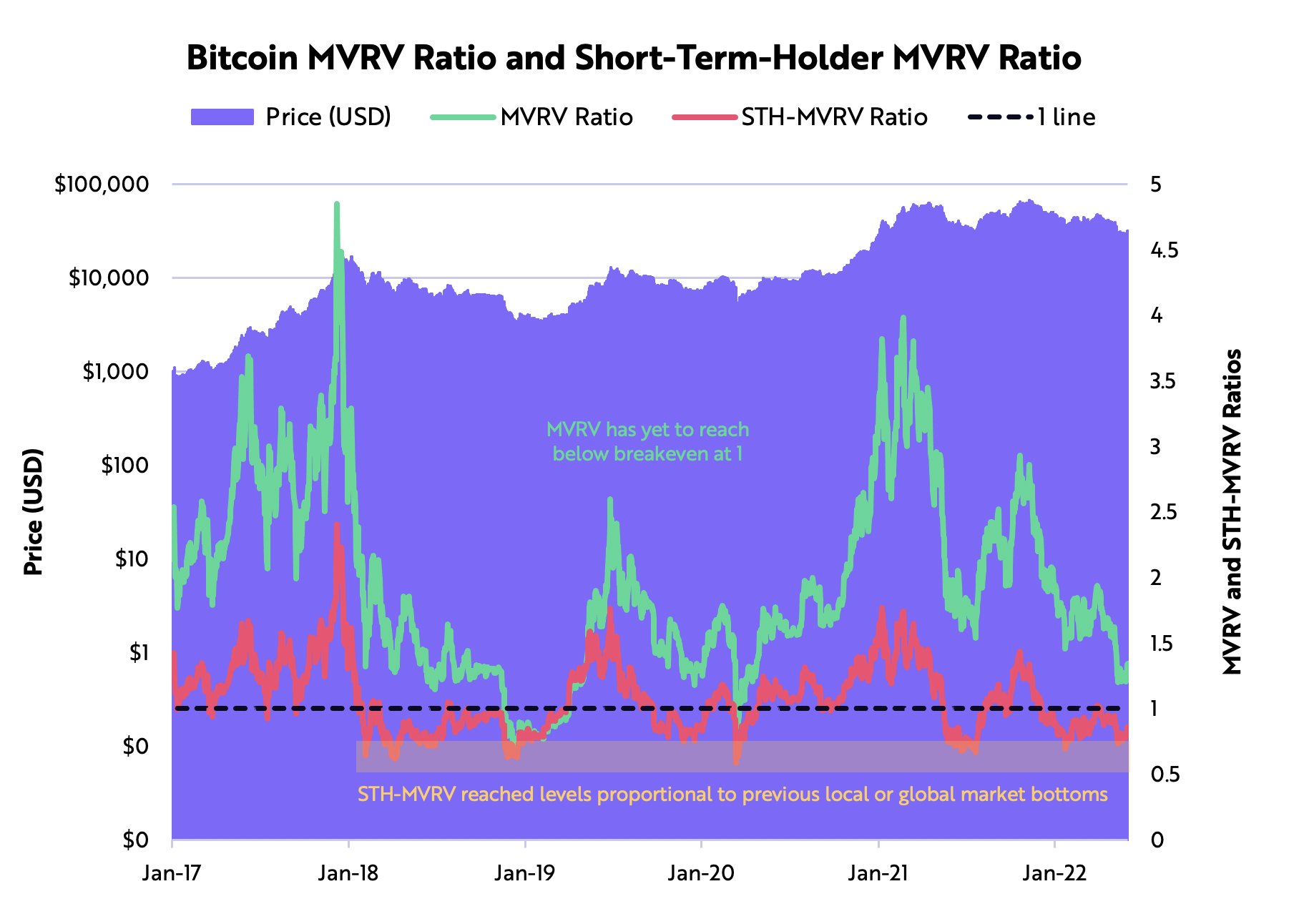

The MVRV ratio, which measures Bitcoin’s market value relative to the flagship cryptocurrency’s realized value, has fallen 35% the breakeven price.

Such levels have been seen since January 2020 and July 2021, according to Elmandjra.

The popular on-chain metric is often used for gauging investors’ mood when investing.

Yet, long-term holders still have diamond hands. At the same time, more than 66% of all Bitcoin in circulation has not moved in over a year, which is yet another record high.

The network’s key fundamentals, such as usage and security, also remain healthy, the analyst says.

Cryptocurrency exchanges saw record-breaking inflows amid the Terra collapse that roiled the cryptocurrency industry last month.

As reported by U.Today, the price of Bitcoin briefly crashed to the $25,000 level. The demist of the Terra blockchain was one of the biggest black swan events crypto has ever seen. However, the market managed to partially recover from the massive fiasco.

Bitcoin is still trading below the $30,000 level at press time. The cryptocurrency is on track to post negative returns for the tenth week in a row.

Now that the largest cryptocurrency is in the middle of another bear market, some believe that it could end up dropping to $12,000 or even all the way back to $8,000.

[ad_2]

Source link